If you’re a Georgia homeowner with equity built up in your home, you have a powerful borrowing option right at your fingertips. Whether you’re planning a renovation, consolidating debt, or covering major expenses, there are two popular ways to tap into your home’s value: a home equity line of credit (HELOC) or a home equity loan.

But which one makes the most sense for your financial goals? Let’s break it down.

What Is Home Equity?

Home equity is the difference between your home’s market value and what you owe on your mortgage. As you pay down your loan or as your property value rises, your equity grows. That equity can then be used as collateral for a loan or line of credit.

What Is a Home Equity Loan?

A home equity loan provides a one-time lump sum with a fixed interest rate and predictable monthly payments. It’s a smart option when you know how much money you need upfront and want the stability of consistent repayment.

Best for:

- Major home improvements

- Large medical bills

- Debt consolidation

- Other one-time expenses

What Is a HELOC?

A home equity line of credit (HELOC) offers flexibility. You’re approved for a credit limit and can borrow from it as needed, like a credit card. HELOCs typically have variable interest rates, so your payments may fluctuate over time.

Best for:

- Ongoing or phased home projects

- College tuition

- Emergency expenses

- Unpredictable costs

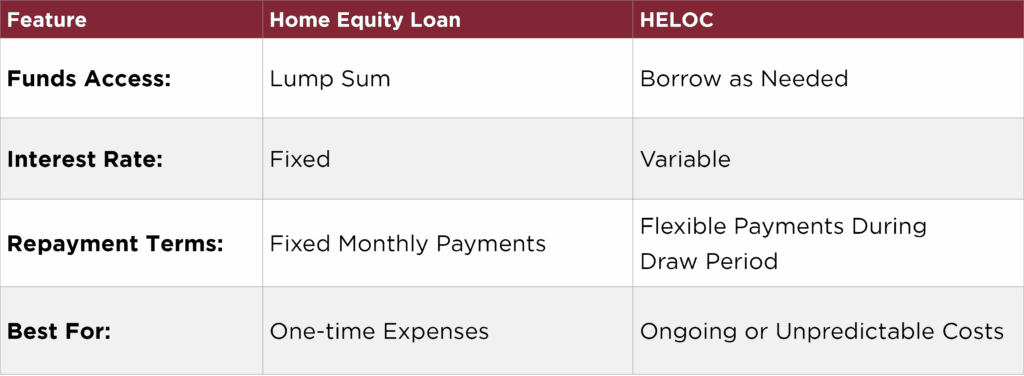

HELOC vs. Home Equity Loan: What’s the Difference?

Which Option Fits Your Georgia Home?

Start by asking yourself: Do I know exactly how much money I’ll need? If the answer is yes, a home equity loan may offer you the clarity and predictability you want. If your costs may change or span over time, a HELOC might be a better fit.

Still not sure? A conversation with a BankSouth lender can help you make the right move.

Why Georgia Homeowners Choose BankSouth

At BankSouth, we understand Georgia homeowners because we live and work right here in the communities we serve. When you work with us, you get:

- Fast, local decision-making from experts who know the market

- Competitive rates and flexible loan structures

- Personalized service from start to finish

- The convenience of modern digital banking with hometown attention

Make Your Equity Work for You

Whether you’re ready to renovate your kitchen, pay off high-interest debt, or plan for college expenses, BankSouth can help you tap into the value of your home with confidence.

Start the conversation today by connecting with a local banker or visiting your nearest BankSouth branch.

Credit and collateral are subject to approval. Terms and conditions apply.

![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government